Why the Loyalty Loop Is Replacing the Purchase Funnel

There’s nothing more valuable than a loyal customer.

In fact, for community banks and credit unions, acquiring a new account holder can cost seven times as much as retaining one. So why would financial marketers rely on a sales model that doesn’t take existing customers into account?

For years–over a century, in fact–marketing professionals have used the purchase funnel model to represent the consumer journey from discovering a brand to making a purchase. It aptly illustrates the initial conversion of a prospect to a customer, but it neglects the essential next phases of customer experience, where long-term relationships are made.

Enter the loyalty loop.

Read on to learn more about this enhanced marketing model and how financial leaders can use it to their advantage.

COMPARING THE MODELS

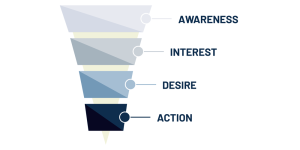

First, let’s look at a typical purchase funnel:

This model proposes that consumers progress through a linear sequence of stages, beginning in a cognitive phase (awareness) and culminating in a behavioral phase (action). This theoretical framework was reduced to its simplest terms by Grande-Butera et al.: “I see it, I like it, I want it, I got it.” The purchase funnel can provide valuable insights about customer acquisition, but that’s where it ends.

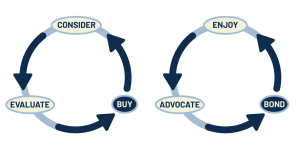

Now, let’s look at the loyalty loop:

As you can see, this model outlines the initial customer journey (from consider to buy), but it adds on a cycle where customers continually reevaluate their purchase decision–and where institutions have the opportunity to validate that decision. That cycle is usually subdivided into three phases:

- Enjoy: In this phase, customers reconcile their expectations with their experience. As the word suggests, it’s not just about whether the product or service meets their immediate needs–it’s also about whether the entire process was positive. Stellar customer service interactions and user-friendly interfaces are key.

- Advocate: This is when customers talk to their friends and family–or post on social media–about their experience, good or bad. Word of mouth has always been powerful, and online reviews increasingly hold sway, with 84% of people trusting them as much as personal recommendations.

- Bond: Once customers are happy and talking about it, institutions need to reengage them with meaningful messaging and value propositions that encourage their continued loyalty. And, as the loop signifies, you can’t just do this once—it’s an iterative system that allows relationships to gradually deepen.

MAKING IT WORK

So, how can community banks and credit unions put the loyalty loop into action? Here are six tips for better managing the customer experience:

- Acknowledge: Today’s consumers have a wealth of choices when it comes to where to spend their money–and where to deposit it. It’s important to let people know that their business is appreciated on a personal level every time they reaffirm their commitment to your institution.

- Inquire: In order to add value for your customers, you need to know what your customers value. Some companies have rolled out elaborate loyalty programs that are considered irrelevant, or even irksome when they generate unwanted messaging. Get to know your audience’s specific needs and goals.

- Experiment: Make use of A/B testing, social listening, and other analytics tools to understand who engages with your messaging. Don’t use conversion as your only benchmark–marketing content doesn’t have to show instant payoffs if it can inform, inspire, and reassure existing customers and prospects alike.

- Enliven: Create “curiosity gaps” that raise anticipation for next steps in the customer journey. By intermittently tapping into your account holders’ initial sense of exploration and discovery as they continue around the loyalty loop, you can keep things fresh as you reward their commitment to your institution.

- Respond: Don’t make the common mistake of ignoring negative feedback–especially when it’s posted online. There’s no guarantee that you’ll win back that particular customer, but by addressing their concerns directly and honestly, you’ll demonstrate your credibility and proactive customer service skills to many future prospects.

- Curate: To foster the longest-lasting relationships, financial institutions need to provide experiences, not just products and services. But not every experience has to be an extravaganza. Think in terms of “micro-experiences,” where every face-to-face or virtual interaction is an opportunity to show gratitude and build trust.

When you work with LIGHTSTREAM, you’ve got a dedicated marketing team that truly understands community banking. Are you ready to leverage the loyalty loop and forge stronger relationships with your account holders? Get in touch today.