What You Need to Know About a WCAG Audit for Your Bank or Credit Union

Your website is an important marketing tool that helps your bank or credit union attract new customers and maintain and deepen relationships with current ones. But what if people within your target audiences can’t see elements of your website, hear your informational videos, or effectively navigate to the information they need on your site? Reaching those people could potentially help you grow your customer base and expand individual relationships. A WCAG audit can help you do that.

In this article, we’ll help you better understand what WCAG is, the benefits of a WCAG audit, the types of audits that can be conducted, and why a WCAG audit is not a DIY project.

WHAT WCAG MEANS

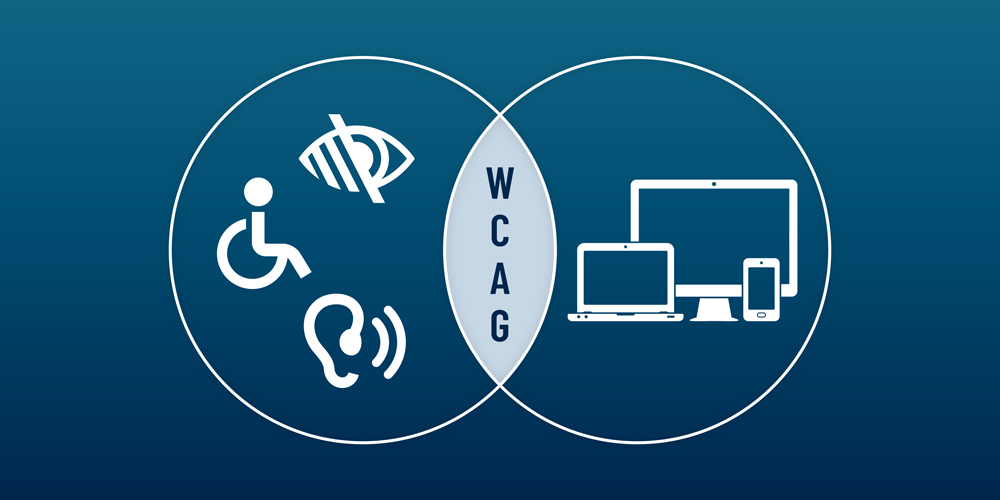

WCAG stands for Web Content Accessibility Guidelines, an internationally recognized set of standards you can use to assess your website’s accessibility to people with disabilities. Conforming to WCAG will make your website welcoming to all visitors, combining practical marketing concerns with your company’s inclusive values in action.

WCAG standards are based on these four principles:

- Perceivable: Can all users perceive the information and interface components on your website? Can they adjust color contrast or font size to suit their needs? Are they able to view captions for videos or alt text that describes images?

- Operable: Regardless of their limitations, can all users navigate your website? Can they use their preferred method of interaction, whether it is voice commands, keystrokes, or mouse manipulations?

- Understandable: Can all users understand the information and instructions presented on your website? Are instructions clear and navigation methods intuitive?

- Robust: Is your website content robust enough for users who rely on assistive technologies? Is the code and content accessible to common devices and tools users might employ to consume your content?

Not all websites can meet the highest level of conformance to WCAG standards. Large government websites that present information for the general public are usually expected to meet the highest accessibility standards, but most others reach full conformance only on certain pages. WCAG conformance is measured on a three-step scale, where Level A is the lowest level of conformance and Level AAA is the highest.

Level A-conforming websites include text alternatives for non-text content, supply substitutes for audio- or video-only content, and offer captions for all video and audio tracks. To raise a Level A website to Level AA, you’d also have to use text that can be enlarged to 200% without losing function or content, avoid using images of text, and set the contrast ratio between text and background to 4.5:1. To achieve Level AAA conformance, that contrast ratio would have to be 1:7, and you would have to offer sign language translations, extended audio descriptions, and text substitutes for all videos on the site.

While banks and credit unions are offering more and more digital services to meet customers’ needs and demands, it’s very common for these digital services to be inaccessible or hard to navigate for people with disabilities.

BENEFITS OF A WCAG AUDIT

You know your website is an important tool for communicating with current and prospective customers and building your brand. A WCAG audit can show you how to add value to that website, increasing your reach with prospects and improving your engagement with current customers.

The closer your website conforms to WCAG, the more likely that features like online bill pay, money transfers, and home and auto loan rate comparison tools will be accessible to all users through an enhanced user experience. A WCAG audit can also help you ensure that these transactions are accessible on both computers and mobile devices. That means you will be able to engage – and improve the experience for – any current or potential customers who may have previously struggled with access at other financial institutions. Your customers and site visitors will be more empowered to complete self-service activities without increasing the burden on your call centers or branches. Promoting your inclusive services also makes your bank or credit union look good – positioning you as a socially conscious financial institution that cares about its customers.

Improved accessibility can also enhance your website’s SEO metrics to drive more traffic to your website and improve its ranking. More web traffic can have a positive effect on revenue.

Additionally, conforming to WCAG will reduce your bank’s or credit union’s vulnerability to accessibility lawsuits.

TYPES OF WCAG AUDITS

Website accessibility is a broad concept that can be applied to every aspect of your website. To keep it from becoming overwhelming, WCAG audits are broken down into different types depending on your specific goals.

Evaluation audit: If you want to understand how accessible your website is, an evaluation audit will identify the high-level issues a user with disabilities might have in navigating it. The results of an evaluation audit can help you plan your next steps toward WCAG conformance.

Design audit: If you are designing a new website or tuning up your current site, a design audit can test the new user interface and user experience for accessibility at the wireframe stage. This can help you avoid the need for major design changes after the website is developed.

Validation audit: Once you have made some changes to your website for enhanced accessibility, you can have a validation audit performed on your entire site, some of your web pages, or even just one web page. You’ll learn if the changes effectively enhanced accessibility, and you could earn a Statement of Conformance.

In-depth audit: If you know what WCAG level you want your website to conform to, you can undergo an in-depth audit. This extensive audit will identify all the areas of potential improvement in accessibility on your website and result in a detailed report about what changes you should make to achieve the level of conformance you desire.

Usability audit: Often the most time-consuming type of audit, a usability audit involves people with various disabilities using the website and reporting on issues or barriers to access they experience.

WHY A WCAG AUDIT IS NOT A DIY PROJECT

When it comes to the accessibility of your bank or credit union website, there is a lot at stake. The Americans with Disabilities Act (ADA) does not specifically cover website accessibility, but inaccessible websites can be considered discriminatory. When legal issues are raised, the courts frequently use the WCAG Level AA as a standard measure to determine if a website presents significant barriers to access for people with disabilities.

In many organizations, ensuring website accessibility is a full-time job. Depending on the size of your financial institution and the extent of your website, managing a WCAG audit may be too much to take on as a side project. And it is too important to put it off. A professional WCAG audit should be conducted right away, and the accessibility of your website monitored as you build dynamic content.

Although automated audit tools are available, the important part of the WCAG audit is how you interpret the data. You want an accessibility expert to perform the manual parts of the audit, interpret the data, and make recommendations for improvements to bring your site into conformance with WCAG.

Feeling overwhelmed by the results of your WCAG audit? Contact LIGHTSTREAM for help in developing a plan to implement the changes necessary to bring your website into conformance with WCAG and continue growing your customer base, relationships, and brand.