Features. Your products and services have lots of them, and they’re very competitive. So why did your last campaign for a mortgage, checking account or low-rate auto loan fall short of expectations? For many banks and credit unions, one possible explanation is a failure to translate the offering’s special features into real-life benefits that consumers care about.

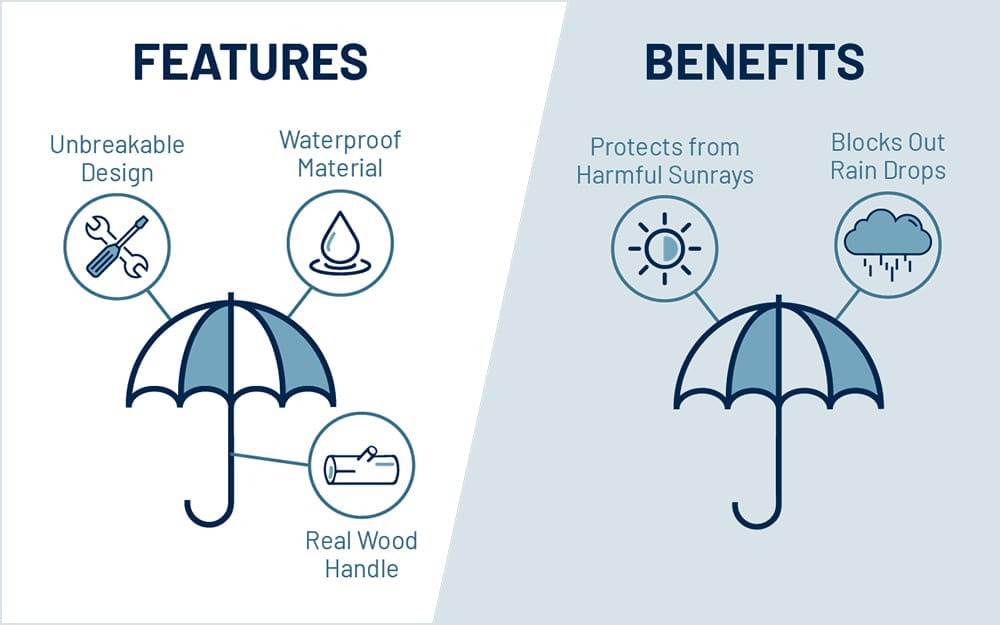

Most of us have heard some version of the mantra, “Focus on the benefits.” To get a better handle on this principle, let’s clarify the difference between a product’s features and its benefits.

Features tell your audience what the product does. Benefits tell your audience what they can do.

Put another way: Features are the what, benefits are the why.

COMMUNICATING VALUE

In some industries, features and benefits are so closely aligned as to be synonymous. For example, Apple doesn’t need to communicate the lifestyle benefits of its iPhone’s longer battery life – the audience easily connects this feature to a more dependable user experience.

But when it comes to most financial products, you’ll need to do more to connect the dots. For bank marketing and credit union marketing, communicating the lifestyle benefits of accounts, loans, and other financial services should be a priority.

TRANSLATING FEATURES TO BENEFITS

Consider two examples that matter to banks and credit unions. Let’s start with a home loan. If your financial institution were to create messaging for its mortgage program that revolves around its features, you might say:

- Competitive rates

- Flexible options

- Local service and processing

An experienced homebuyer may see the value of these features, but many first-time buyers won’t. Instead, let’s think about their practical benefits for the consumer. If we put ourselves in the shoes of the first-time buyer, we can make a few observations about how they feel and what they want:

- They’re nervous about taking this major step

- They find mortgages confusing

- They want the best possible home for their needs

- They want to minimize their financial impact

Knowing these things about our future homeowner, you’ll be better able to identity benefits that matter to them:

- Local service from a friendly, experienced lender

- Step-by-step guidance through the whole process

- A wide range of loans and terms to support the buyer’s unique needs

- Great rates to help keep monthly payments lower

These should be paired with imagery and headlines that show the ways that having a home makes life better, such as a backyard where the kids can play, space for family game nights and get-togethers, the freedom to customize your home, and the pride of homeownership.

Placing an emphasis on benefits becomes even more important when discussing new or unfamiliar products, such as the latest online and mobile tools. If your institution has a new mobile banking app, you’ll want messaging that highlights the convenience it brings to consumers’ lives:

- Deposit checks anywhere to avoid the hassle of trips to a branch

- Enjoy more free time by paying bills with a few taps

- Prevent costly overdrafts by getting low-balance alerts

- Get a clearer picture of your personal finances with easy-to-use financial management tools

SIMPLICITY IS KEY

The key to identifying benefits is to understand your audience’s intent. When it comes to financial matters – an intimidating subject for many – intent usually boils down to ease and simplicity: an easier mortgage process, simpler day-to-day banking, interest rates that make goals more attainable, and trusted guidance to help with making important decisions.

In the examples above, the benefits satisfied an emotional need as well as practical ones: supporting major goals, having more time to relax, avoiding financial stress, and so on. When communicated effectively, these are benefits your audience can feel.

5 WAYS TO PUT BENEFITS FIRST

These best practices can help put your financial institution’s benefits – and the consumer’s experience – at the forefront of each campaign:

- Speak to the real-world use of the product or service: There’s always a way to describe a feature in terms of how it fulfills a specific consumer need. “Reimbursements for out-of-network ATM fees” is a great account feature. But “Use any ATM you want” is a great benefit.

- Get more creative with headlines: Unless you have a killer rate or cash bonus to promote, take a cue from the big lifestyle brands and focus on things like freedom, independence, and personal success. Let supporting copy explain the details of your offer.

- Rethink your bullet points: As we saw above, there’s often more than one way to list products’ features. Whenever possible, give practical details an emotional touch. “Watch your savings grow” is a more aspirational way of saying “Check your balance online.”

- Use lots of second person: “You” is the magic word when it comes to benefit-driven messaging. “This account pays a great rate” is less engaging than “You’ll earn a great rate.”

- Focus on simplicity: Google and Amazon earned their success by giving consumers the best possible experience with the least amount of effort. Consumers want the same ease when it comes to banking, saving, borrowing, and planning. Copy and imagery should always show how your products make these things as effortless as possible.

If you’re ready to go beyond surface-level features in your financial marketing, talk to Lightstream. Our experienced team digs deeper to identify your audience’s key motivations, then creates engaging print and digital content that puts their experience front and center. To learn how we can support your next campaign, reach out today.