Citizens Bank: Driving Deposit Growth With a Next-Generation Campaign

How can a bank with a deep local history connect with the next generation – while driving deposit growth?

This is the challenge that Citizens Bank of Tennessee brought to Lightstream.

The 90-year-old bank wanted to leverage its strong local brand to grow deposits and attract younger, digital-savvy consumers – a key success factor for any legacy bank. To that end, the bank needed to:

- Reach a mobile-first audience: Younger generations expect a seamless, end-to-end digital experience.

- Help millennials and Gen Z to save: Many have fallen behind when it comes to saving. In fact, roughly one-third of the members of these generations have no emergency savings, according to a 2024 Bankrate survey.

- Stand out in the market: Elevated savings rates presented a big opportunity for consumers but stiff competition among banks.

The bank planned a certificate of deposit promotion with an enticing APY and the ability to open online. This was paired with an offer for the bank’s digital-first checking product, which catered to younger customers who prefer paying by debit card and banking online (activities that could qualify them for a premium rate).

At that point, Citizens Bank needed help reaching the right audience.

LIGHTSTREAM ROSE TO THE CHALLENGE

Citizens Bank turned to our Lightstream team to craft and deploy a cross-channel paid media campaign that spanned Google Ads (including search, display, and remarketing), pushing traffic to an attractive, streamlined landing page to drive account openings.

The campaign leveraged AMPHTML ads, which have smaller file sizes for faster rendering. This can result in higher click-through rates by creating a better experience on mobile – making these ads a smart fit for the intended audience.

CREATIVE THAT DROVE HOME THE MESSAGE

The campaign hinged on a simple and effective tagline – “Go Higher. Start Here.” – enhanced by bold, on-brand visuals that kept the promotional rate front and center.

Midway through the campaign, Citizens Bank also introduced a 10-month CD, as well as rate increases. Our team acted quickly to update the campaign assets and refresh the imagery.

HIGH CLICK-THROUGH RATES, LOW CUSTOMER ACQUISITION COSTS

Over its eight-month run, the campaign generated more than 3 million impressions and 26,000 interactions.

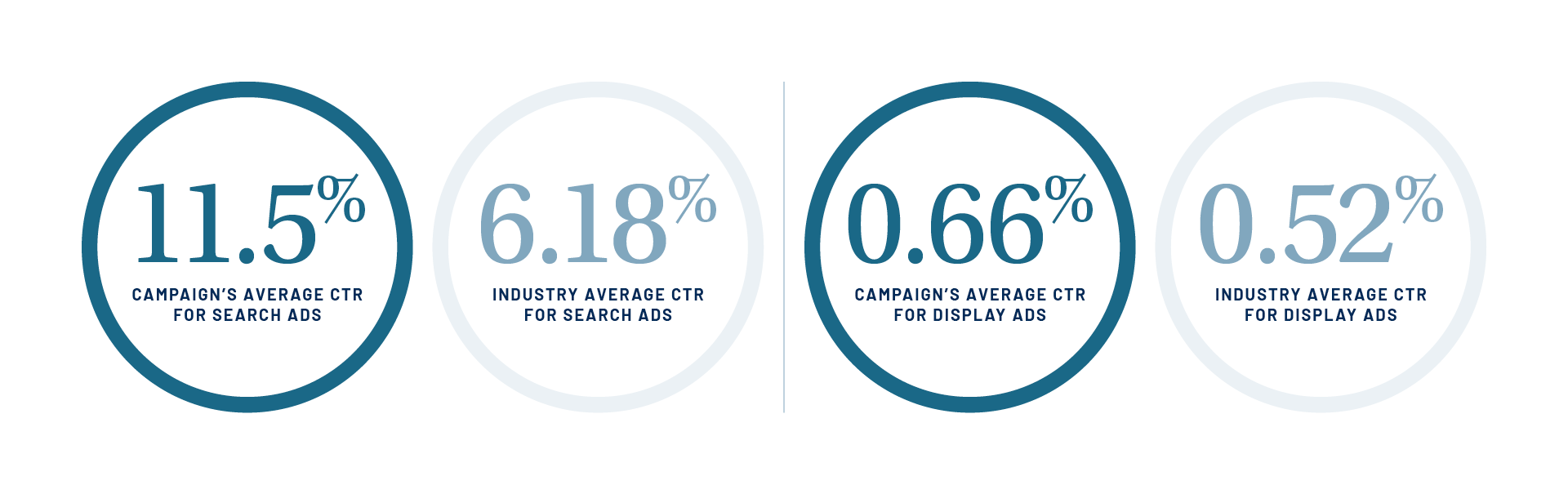

The campaign’s efficiency could be seen through its solid click-through rates, which surpassed industry averages.

Most importantly, the high engagement helped drive new business.

The digital marketing campaign generated more than 1,200 account openings at a low cost of about $25 per account – an impressive feat for any community bank.

DIGITAL SAVVY + BANK MARKETING EXPERTISE

For bank marketers looking to boost deposits, attract and keep younger consumers, and defend their market share, effective digital campaigns are a must.

When it’s time to launch yours, turn to Lightstream for:

- Digital strategy: Lightstream’s in-house strategists and creative team have executed successful campaigns for banks and credit unions across the country. We know what works.

- Banking know-how: We partner with financial brands day in and day out. Because we already understand your products and goals, we’re ready to hit the ground running.

- Flexibility and value: We operate on a project-by-project basis with a low hourly rate, allowing plenty of flexibility for you and your budget.

Looking to boost the ROI of your next digital marketing campaign? Reach out and let’s talk about your goals.