Optimize Your Insurance Marketing With the Flywheel Model

If your current marketing strategy isn’t producing the results you need for your insurance brand, it could be because you’re focusing too closely on converting leads instead of retaining customers.

Traditionally, insurance marketing has focused on the sales funnel, concentrating on new leads and mapping marketing touchpoints along the buyer’s journey until a prospect is converted to a customer. The problem with this approach? Once a prospect has converted, marketing touchpoints level off.

Although the sales funnel has historically been a successful model, more insurance marketing leaders now need help to get results from this strategy. That’s because passive loyalty can set in without carefully cultivating existing customers. That makes it more than likely your hard-won conversions can switch to competing brands.

The remedy many marketers are turning to is the flywheel model. This marketing method is designed to generate a consistent stream of leads and prospects and focuses on conversion and retaining them as loyal customers. By focusing on increasing customer retention, the flywheel strategy turns current customers into promoters, contributing to generating more leads and prospects. In short, the flywheel method is a self-sustaining strategy.

For insurance marketers, implementing the flywheel method in your strategy can help you drive growth more effectively.

SALES FUNNEL VS. FLYWHEEL

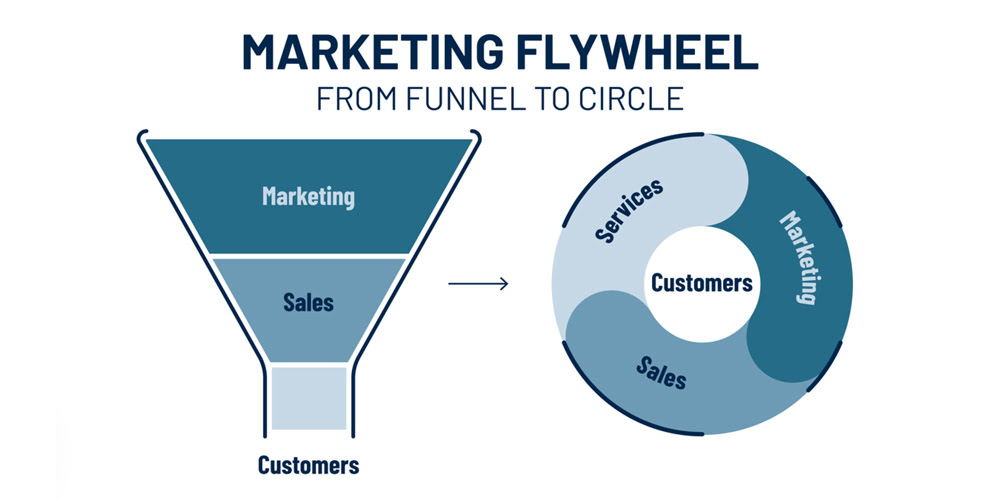

While both the flywheel and sales funnel strategies focus on converting people from prospects into customers, the process for each is quite different.

The traditional sales funnel is a transaction-focused, linear model. It outlines the customer journey from awareness to interest to consideration and finally, hopefully, action. And that’s where it ends. Once a prospect has moved through the sales funnel and become a customer, there’s no dedicated pathway for retaining them and turning them into a loyal and repeat customer and advocate of your brand.

That’s where the flywheel strategy differs from the sales funnel. The flywheel puts the customer at the center at every stage. It helps you create a complete customer journey, identify touchpoints across that entire journey, and understand your customers’ needs and wants at each of those touchpoints. Where the sales funnel progresses only from attracting leads to engaging prospects to converting them to customers, the flywheel accelerates at the point of customer conversion to increase engagement so that customers become promoters or brand ambassadors.

ADVANTAGES OF THE FLYWHEEL MODEL

As a successful insurance marketer, your role is to champion innovation and embrace strategies that deliver value and results. The flywheel model offers a transformative approach that aligns with the demands of modern customers – and provides key benefits for your insurance brand.

- More Qualified Leads: The flywheel model emphasizes a deep understanding of policyholders’ needs, preferences, and pain points. By crafting content and initiatives centered around these insights, insurance companies can attract leads who are genuinely interested in specific insurance products and more likely to convert. The flywheel model banks on satisfied customers to become brand advocates. When existing policyholders share their positive experiences, it brings in leads that already have a seed of trust planted, thanks to these testimonials.

- More Team Interaction: The flywheel’s emphasis on departmental collaboration means that feedback from the field (from sales and customer service teams) can directly influence product design and customer service protocols, ensuring products and customer care meet the market’s needs.

- Customer Retention and Bottom-Line Growth: The cyclical nature of the flywheel puts a significant emphasis on post-sale interactions. In the insurance world, this means not only ensuring claims are processed efficiently but also checking in with policyholders, offering them timely policy upgrades or new products based on their evolving needs. A satisfied policyholder is more likely to renew and expand their coverage.

Retaining an existing policyholder is often more cost-effective than acquiring a new one, especially considering the long sales cycles and trust-building required in insurance. The flywheel’s focus on customer satisfaction ensures that insurance brands can achieve consistent growth while potentially reducing the hefty costs associated with new customer acquisition.

CRAFTING A FLYWHEEL-FOCUSED CONTENT STRATEGY

When applying the flywheel strategy to the insurance industry, consider the following approach:

1. Attract: Just as in any other industry, attracting clients to your insurance business is the starting point. This can be through content marketing, PPC advertising, social media, or any other method that targets your ideal customers. Given that the insurance industry often deals with complex topics, educational content can be a powerful tool at this stage.

2. Engage: Once you have attracted potential clients, it’s essential to engage them. This can be done by:

- Offering valuable advice tailored to individual needs.

- Providing calculators or tools that help them assess their insurance requirements.

- Offering webinars or seminars on insurance-related topics.

- Engaging through personalized email campaigns.

3. Delight: This stage focuses on exceeding expectations.

- Offer excellent customer service.

- Simplify the claim process.

- Provide regular check-ins or policy reviews.

- Offer loyalty discounts or referral bonuses.

4. Referrals and Reviews: A satisfied client in the insurance industry is more likely to refer others, given the trust-based nature of the industry. Encourage referrals by:

- Requesting online reviews or testimonials.

- Creating a referral program with incentives.

- Sharing client success stories (with permission).

5. Retention: Insurance is often a long-term business. Once someone is a policyholder, it’s essential to keep them satisfied. Regular communication, policy updates, and quick claim processing are crucial.

6. Leverage Technology: In the modern era, technology can significantly enhance the flywheel’s momentum. Use chatbots for instant queries, CRM systems for personalized follow-ups, and digital platforms for easy policy management.

7. Continuous Feedback Loop: The flywheel is about continuous improvement. Regularly seek feedback from clients and use that information to refine your offerings and improve your service.

The key is to ensure that every stage of the customer journey, from the first touchpoint to the post-sale service, is optimized to create delighted customers who will naturally want to promote your insurance business.

REDUCE FRICTION IN YOUR FLYWHEEL

While the flywheel enhances the overall customer experience, it’s crucial to identify and eliminate friction points to help keep your flywheel spinning smoothly. This involves analyzing customer touchpoints, optimizing processes, and leveraging data to provide seamless interactions.

Friction refers to anything that can potentially slow down your flywheel, such as inefficient internal processes, poor communication between departments, or misaligned values between your employees and customers.

You can reduce friction by examining how your teams are structured, where prospects are getting stuck, and why customers aren’t becoming repeat customers.

By decreasing friction and increasing the speed of your flywheel, you’ll create more promoters for your insurance brand. Those promoters will help your flywheel keep spinning, generating more leads and prospects.

WAYS TO MEASURE SUCCESS

As an insurance marketing leader, you understand the importance of data-driven decisions. When it comes to the flywheel, metrics shift from focusing solely on conversions to measuring customer engagement, retention rates, customer lifetime value, and net promoter scores. These performance indicators reflect the flywheel’s impact on your brand’s growth and success.

By shifting from the traditional funnel to the flywheel, you’ll position your insurance brand to drive efficiency, enhance customer experiences, and cultivate sustainable growth.

At LIGHTSTREAM, we know what works for insurance marketers, and we offer a full array of branding and creative services to help your brand succeed. Connect with us today to learn more.